Jill Overmyer

In the event of a burglary or disaster that destroys some or all of your personal belongings, an inventory checklist of your home can be invaluable when you file a homeowner’s insurance claim. A home inventory lists your belongings and valuables, their features and their value.

According to the Insurance Information Institute, a few benefits of keeping an up-to-date inventory checklist include:

- Ensuring that you don’t over-insure or underinsure your belongings.

- Settling your insurance claim faster and with less hassle over prices and value.

- Helping you track your belongings and personal possessions.

- Allowing you to buy additional coverage for valuables such as jewelry and collections, which may be excluded from your homeowner’s insurance.

Home inventory checklist can be a blessing when you lose everything

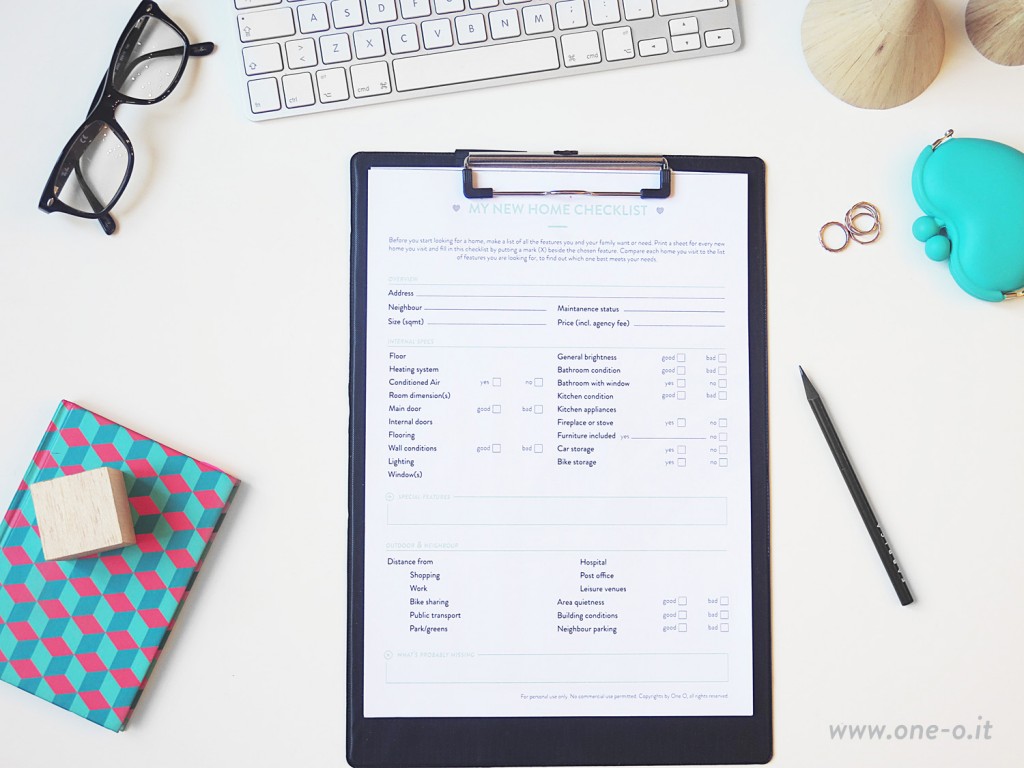

How to make an inventory checklist

The more detailed your inventory, the better. But it doesn’t need to be too complicated. An easy way to do a home inventory is room by room, listing and photographing the contents of each room and jotting down descriptions and details. Your home inventory checklist, according to State Farm Insurance, should include:

- Brand names and serial numbers of products.

- Digital photographs, preferably stored on a disc or flash drive.

- Receipts. If you don’t save receipts, now is a good time to start.

Most homeowner’s insurance policies limit the amount they will cover for valuables like jewelry, collections, furs and other valuables. If you have valuables that exceed coverage limits, you will need to get appraisals for each item and insure them separately. Once you have an inventory and appraisals, store them in a safe deposit box away from home.

Be careful not to make the mistake of underinsuring by assuming that, because an item is under a manufacturer’s warranty, it is fully covered. More often than not, the manufacturer’s warranty covers basic repairs or replacement of parts caused by malfunction — not loss from disasters or theft. Moreover, buying a manufacturer’s warranty at the store might lead to extra coverage you don’t need if you already have homeowner’s insurance coverage, according to the National Association of Insurance Commissioners .

Keeping your inventory updated

Make sure you update your inventory when you add additional contents to your home, as well as when you sell them or give them away. This is especially true during the holiday season, when most people accumulate gifts. Failing to keep your inventory updated could result in not enough (or too much) insurance coverage.

So if you sell your prized coin collection for a large sum, receive a flat-screen TV for Christmas or inherit your great-grandmother’s jewelry collection, you will want to contact your insurance agent and adjust your coverage accordingly.

Ideally, you never will need to file a homeowner’s insurance claim because of a loss. In the event you do, however, an updated home inventory checklist can make the process faster and easier and help you get the most from your claim.

3 thoughts on “Home inventory checklist can be a blessing when you lose everything”